-

About

-

Membership

-

Pubs & Clubs

-

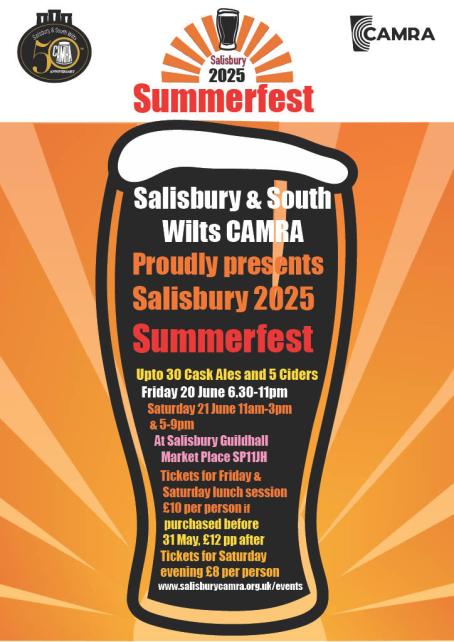

Events & Festivals

-

Beers & Breweries

-

Cider & Perry

-

Take Action

- Shop

- Learn & Discover

- Volunteer Resources Area

- My Trips